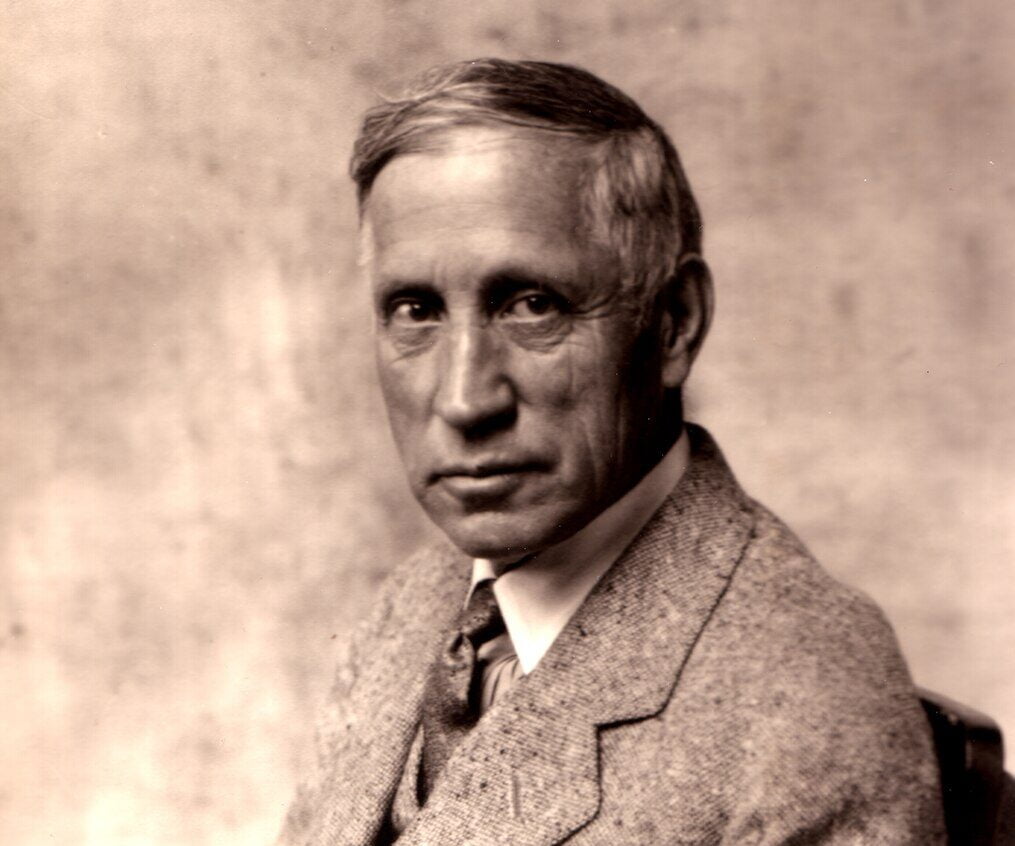

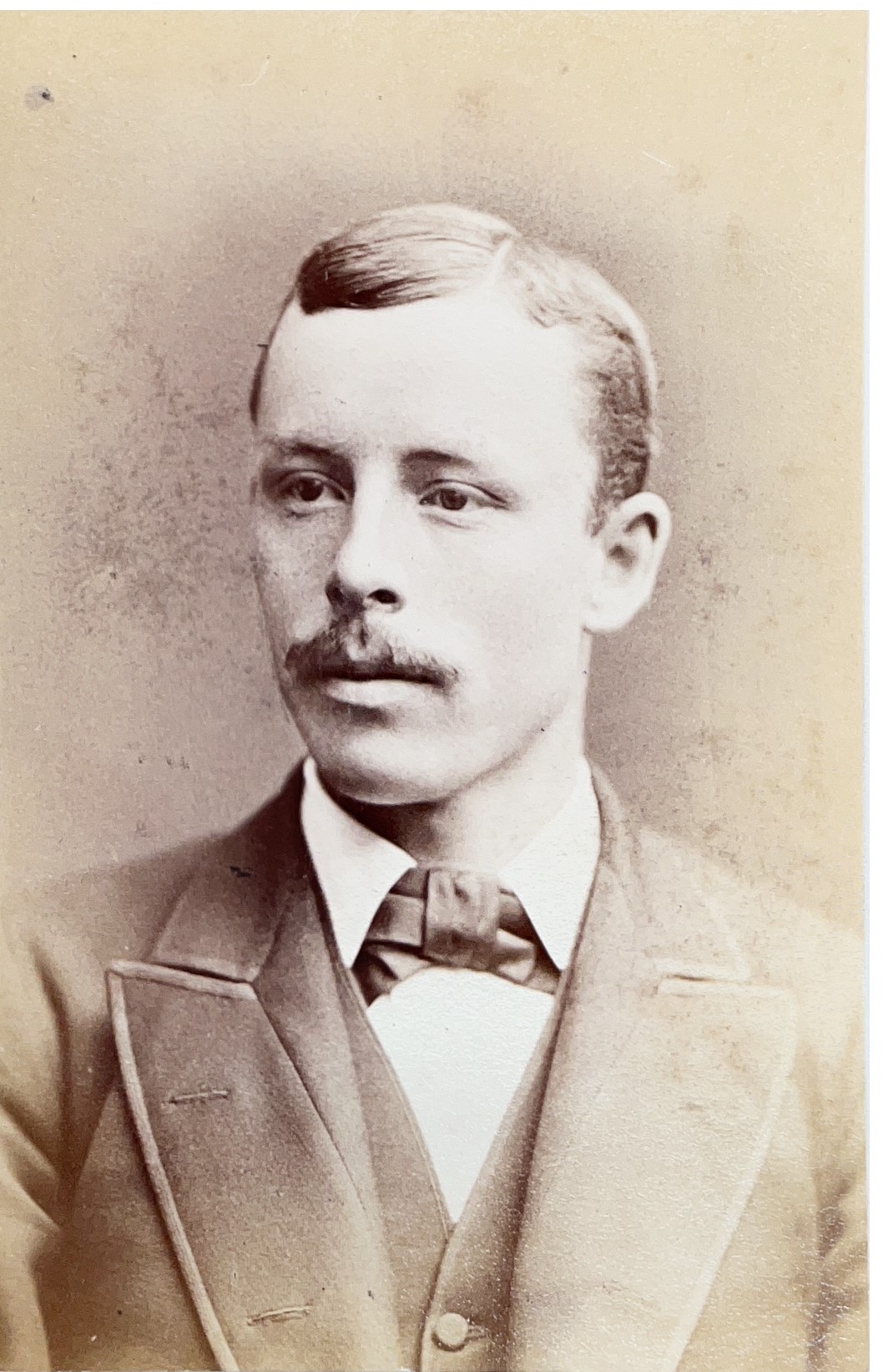

Frederick Fiske Warren

July 2, 1862-February 2, 1938Frederick Fiske Warren was a wealthy paper manufacturer, supporter of the arts, 1893 U.S. men’s singles tennis champion, anti-imperialist, and Harvard’s largest-ever landowner. He married Gretchen Osgood, famous in her own right as a singer, poet, and actress, in 1891, the same year he bought his first property, a summer home in Harvard. Gretchen and their daughter Rachel are portrayed by John Singer Sargent in Mrs. Fiske Warren (Gretchen Osgood) and Her Daughter Rachel (1903), now in Boston’s Museum of Fine Arts. Warren eventually accumulated over 600 acres of land in Harvard, including most of that around Bare Hill Pond as well as that belonging to the Shakers, which he purchased after the community dissolved in 1918.

Fiske Warren is most famous as a staunch advocate of Henry George’s single-tax system, a version of which he attempted to create in Harvard. Warren, like George, believed that such a system would foster economic development while preventing its frequent correlates, including poverty, inequality, unemployment, and crime. In this system, land is held to be the common inheritance of all; it can only be rented, not owned. Renters would pay a single tax–essentially a property tax–to the community in exchange for their use of this collectively-owned resource. They would not, however, pay any taxes on buildings or other improvements, nor would they be taxed on profits made from the productive use of land, whether they be derived from farming, factories, or other activities. This would encourage development and discourage speculation and other unproductive uses of land, since the tax rate would be in all cases the same.

Warren created two single-tax enclaves in Harvard which, like those created by others elsewhere, were intended to demonstrate the virtues of the system and encourage its adoption by governments. The first, known as the Tahanto Enclave, was established on Warren’s property around Bare Hill Pond; the second, and much smaller enclave, known as Shakerton, was created on the land he purchased from the former Shaker community. Warren offered free land with 99-year leases to people who wanted to build homes and/or establish businesses. They in turn would pay an “economic rent” in the form of taxes which in theory would cover all local, state, and federal taxes as well as provide some funds for community needs and projects. In practice, the rents paid covered local property taxes and only a fraction of state and federal ones. Taxes not covered by the rent were paid by Warren himself, the main reason the enclaves did not survive for long after his death. Many of the enclaves’ residents purchased the land they occupied from Warren’s heirs.

More about Harvard people...